Career Advice for the Smart Job Seeker

Insights on elevating your resume, job search and personal growth

Why You Should Assess the Financial Health of Potential Employers

When you’re on the job hunt, it’s easy to get caught up in the excitement of finding a role that ticks all the right boxes.

And that’s absolutely fantastic – we couldn’t be happier for you.

However, there’s just one more thing that needs to be done to ensure that this is truly the right move for you.

We’re not trying to be a wet blanket, but this has to be said: Understanding a company’s financial stability before accepting a job offer (even before attending an interview if possible) is essential.

By assessing a company’s financial health, you ensure that you’re stepping into a stable and secure environment. It can save you from the stress of unexpected layoffs, budget cuts, or even company closures down the line.

But don’t worry. You don’t have to be an accounting whiz to figure this out. In fact, everything you need to know is summarized below (you’re welcome!).

But first things first…

Why assessing financial health is important

Before assessing a company’s financial health, let’s dive into why it’s important.

The financial stability of a company directly impacts its ability to pay salaries, invest in employee development, and maintain a positive working environment. If a company is struggling financially, you might face:

-

Job insecurity, with a high chance of layoffs or reduced working hours down the line

-

Delayed salary payments

-

Limited resources due to lack of investment in tools, training, and career advancement

-

Increased pressure and a stressful work atmosphere due to financial constraints

That, in a nutshell is why you must take time to research and understand a potential employer’s financial situation as part of your job search process.

So… how can I find this information?

There are lots of ways to get a clearer picture of a company’s financial health. The most useful (and easy-to-access) ways are;

#1 The company’s website

For publicly traded companies, their own websites are treasure troves of financial information. Most organizations have a dedicated section for investors, often labeled “Investor Relations " or “Investors.”

Here, you can find:

-

Annual Reports: Comprehensive documents that include the company’s financial statements, management discussion, and analysis.

-

Earnings Calls: Transcripts or recordings of calls where company executives discuss financial performance and future outlook.

-

SEC Filings: Documents filed with the Securities and Exchange Commission, providing detailed financial data and disclosures.

These resources can give you a pretty good understanding of the company’s revenue, profitability, and overall financial health.

#2 Financial news sites and platforms

Websites like Yahoo Finance , Google Finance, and Bloomberg offer detailed financial information and analyses.

You can find here:

-

Data on stock prices, historical trends, and market performance.

-

Updates on company news, financial health, and expert opinions.

-

Insights from financial analysts on the company’s performance and future prospects.

As these sites generally research and analyze their findings independently, these are generally considered reliable sources of non-biased insight.

#3 Internet Search

For private companies or those less transparent with their financials, doing your own online search can be revealing. Use search terms like “annual report [company name]” or “financial results [company name]” to find relevant information.

While private companies aren’t required to disclose as much information as public ones, you can often find press releases, news articles, or industry reports that shed light on their financial health.

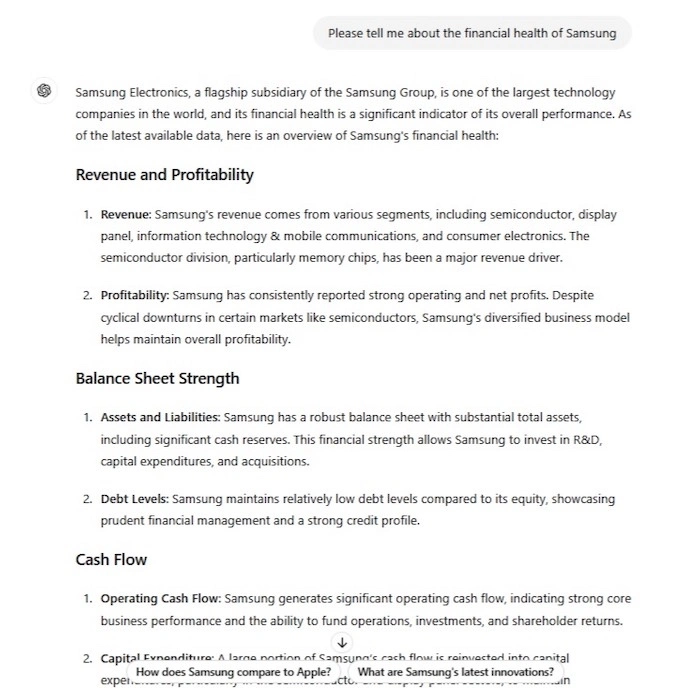

#4 ChatGPT

Using AI tools like ChatGPT can be another way to gather information. While the data might not always be the most current, it can provide a historical perspective and broader understanding of the company’s financial trajectory.

Try prompts such as, “Please tell me about the financial health of [company name],” to get a summary of the company’s revenue, profitability, market performance, cash flow, and debt levels.

What to do with the information you’ve gathered

Once you’ve collected information from all these sources, now’s the time to analyze it critically and, if possible, use it to inform your interactions with the company.

Here are some practical tips and follow-up interview questions to consider:

Analyzing financial information

-

Look for consistent growth in revenue and profits over the past few years. Declining or volatile trends may indicate financial instability.

-

High levels of debt relative to equity can be a red flag, indicating potential cash flow problems.

-

Positive and consistent cash flow is a good indicator of financial health, suggesting that the company can cover its expenses and invest in growth.

Follow-up interview questions

When you’re at interview stage, don’t hesitate to ask questions that can give you more insight into the company’s financial health and stability (no need to be blunt; they are more likely to be open if you approach it diplomatically and with curiosity). For example:

-

“Can you tell me more about the company’s growth plans over the next few years?” This can give you an idea of the company’s future outlook and financial planning.

-

“How does the company handle economic downturns or market fluctuations?” Understanding the company’s resilience and contingency plans can provide reassurance.

-

“Can you describe the company’s approach to financial management and budgeting?” This question can help you gauge the company’s financial prudence and stability.

Conclusion

Assessing the financial health of a potential employer is a vital step that should definitely not be overlooked in your job search.

By utilizing resources like the company’s website, financial news platforms, internet searches, and AI tools like ChatGPT, you can gather incredibly comprehensive information about a company’s financial stability.

Understanding this data, and asking insightful questions during interviews, can help you make an informed decision, ensuring that your next career move is into a stable and supportive environment.

A little research can go a long way in ensuring your job security and career growth! Before accepting that fantastic offer, take the time to dig deeper into the company’s financial health. Your future self may thank you!

Key takeaways

-

Assessing a company’s financial stability before accepting a job offer helps avoid issues like layoffs, delayed salaries, limited resources, and a stressful work environment.

-

A company’s financial health affects its ability to pay salaries, invest in employee development, and maintain a positive workplace.

-

Financial information for publicly traded companies can be found on their websites under “Investors” or ‘Investor Relations,” including annual reports, earnings calls, and SEC filings.

-

Financial websites like Yahoo Finance, Google Finance, and Bloomberg provide detailed financial information, stock data, market performance, and expert analyses about thousands of companies.

-

If a company is new or private, you may have to do your own research. Use search terms like “annual report [company name]” or “financial results [company name]” to find out more.

-

AI tools like ChatGPT offer historical perspectives and broader understanding of a company’s financial trajectory.

-

Analyzing financial data for growth, debt levels, and cash flow, and asking strategic interview questions about growth plans, economic resilience, and financial management, will help you to gain a broader understanding.

Related questions

Why should I assess the financial health of a potential employer?

Assessing financial health helps avoid job insecurity, delayed salaries, and limited resources, ensuring a stable and supportive work environment.

How can I find a company's financial health before a job interview?

You can find financial information on the company's website, financial news platforms, through internet searches, and using AI tools like ChatGPT.

What resources are available to check a public company's financial stability?

Public companies often have financial information in the “Investor” or "Investor Relations" section of their website, including annual reports, earnings calls, and SEC filings.

What should I look for in a company's financial statements?

Look for consistent growth in revenue and profits, manageable debt levels, and positive cash flow, indicating financial stability.

Where can I find unbiased financial analyses of a company?

Websites like Yahoo Finance, Google Finance, and Bloomberg provide detailed financial information and expert analyses.

How can I find financial information on a private company?

Use specific search terms to find press releases, news articles, and industry reports that shed light on a private company's financial health.

Can AI tools help me assess a company's financial health?

Yes, AI tools like ChatGPT can provide historical perspectives and broader understanding of a company's financial trajectory.

What questions should I ask in an interview about a company's financial health?

Ask about the company's growth plans, handling of economic downturns, and approach to financial management and budgeting.

How does a company's financial stability impact employees?

Financial stability affects salary payments, investment in employee development, and overall job security and workplace environment.

What are the signs of a financially unstable company?

Signs include declining or volatile revenue and profits, high debt levels, and inconsistent cash flow, which can lead to job insecurity and resource constraints.

Explore more articles

- Stressed? Try These (Secret) Mindfulness and Meditation Techniques

- It's Not Up To Your Boss: Why Upskilling Is YOUR Responsibility!

- It's Not You, It's Them: How to Handle Workplace Bullies

- What Are Group and Panel Interviews and How to Ace Them!

- Decoding Job Descriptions: Here’s What Employers REALLY Want!

- Eyeing A New Job? How to Fix Job Skills Gaps BEFORE You Apply!

- The 'Why' Factor: How Defining Your Purpose Can Transform Your Career

- How to Decode Interview Feedback to Smash the Next One!

- We Broke Down a Typical Employment Contract Here's What It Means!

- 7 Steps to Landing an Amazing (Unadvertised) Job